Click Here to See Our Current Deposit Rates

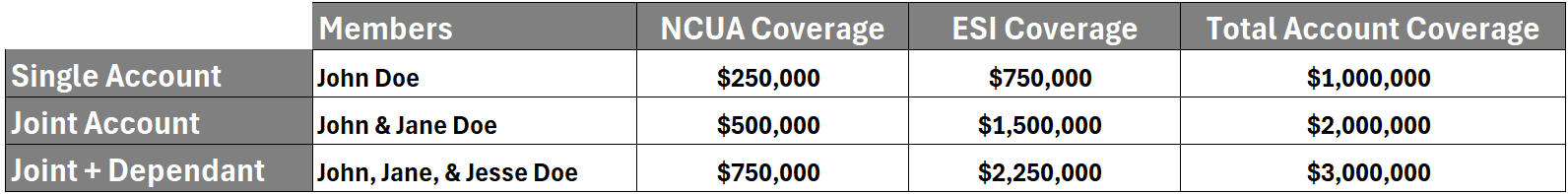

All Access CCU deposits are federally insured by the NCUA up to $250,000 per member, with an additional $750,000 in coverage provided by ESI (Excess Share Insurance) at no cost to you. This covers each member up to $1,000,000 with total coverage increasing by adding joint owners and/or beneficiaries to your account, including IRA accounts. See chart below for an example.

For additional coverage questions, please contact a member service representative by clicking here

Savings Options for Everyone

We offer our members a variety of savings account options with competitive rates to help you and your family reach your financial goals. From saving for your first car to retirement, we are here to help your money grow no matter what stage of life you are in.

Everyone should have a safe place to put their hard-earned dollars. A traditional savings account at Access CCU is free, offers competitive interest rates, free access to ATMs all over the city and country, while helping you save for the future.

Certificates of Deposit offer a secure investment while earning higher interest than traditional savings accounts. Our CD's compound interest on a monthly basis, helping you earn even more. Click

HERE to see our current deposit rates.

Minimum deposit of $1,000

Deposit terms range from 6 months to 5 years

Federally insured by the NCUA up to $250,000 with an additional $750,000 of insurance by ESI(Excess Share Insurance)

You can renew your CD through email by sending a request to cdrenewal@accesscu.net

A Money Market Account is an excellent savings tool that earns higher interest than traditional savings, but allows you more flexibility with your money than a Certificate of Deposit.

Minimum balance of $2,500. If balance falls below $2,500 a fee may apply.

Federally insured by the NCUA up to $250,000 with an additional $750,000 of insurance by ESI(Excess Share Insurance)

You can withdraw money from your money market account up to 6 times per month without any fees.

IRA's provide you with a tax vehicle while saving for retirement. We offer both Traditional and Roth IRA's.

Traditional IRA's

Traditional IRA's allow you to make tax-deductible contributions to the account up to a certain annual amount depending on your age. In addition, you avoid paying taxes on the interest earned until you withdraw the money for retirement. We offer both savings and Certificates of Deposits for Traditional IRA's.

Roth IRA's

A Roth IRA allows you to make contributions to the account that are not tax deductible, but you DO NOT pay taxes on the interest earned when you withdrawal the money. This means once you are at retirement age, withdraws from a Roth account come to you tax-free. We offer both savings and Certificates of Deposit for Roth IRA's.

IRA Certificate of Deposit

Once your IRA reaches $10,000 balance you can move the funds into an IRA Certificate of Deposit. Like regular CDs you can earn a higher dividend rate by locking a term of 6, 12, or 24 months. Grow your retirement nest egg starting today with an IRA CD.

Penalties

You will incur financial penalties if you withdrawal money from any IRA before the age of 59 1/2. You must begin withdrawing from any IRA by age 70 1/2.

Access offers options for teaching youth how to begin their financial journey and develop lifelong financial skills.

Sammie Saver Accounts*

Sammie Saver accounts are a fun and rewarding way to encourage young savers to learn the basics of successful personal finance. Click

HERE to learn more.

Kids 5 years and younger can come inside any branch lobby and make a deposit in person and receive a fun reward from the toy chest.

Kids 5 years and older who have a report card can come inside any lobby in person and be rewarded with $10 deposit for straight A’s and $5 deposit for a mix of A’s and B’s. This is a great way to encourage the littles to save and make good grades with fun incentives. They are treated like members, because they are!

TUTMA (Texas Uniform Transfer to Minors Act)

A TUTMA account is a savings account set up for a minor by someone older than 21 years who will serve as the custodian until the minor turns 21. This is a great way to save money for your kids or grandkids while remaining the authorized signer of the funds.

CONVENIENT LOCATIONS

With 4 locations and over 40 ATMs in Amarillo, and over 50,000 ATMs nationwide, you can be sure that you have Access whenever you need it.

FIND A BRANCH OR ATM NEAR YOU

Welcome to Access Community Credit Union in Amarillo, Texas!

At Access Community Credit Union, we believe in providing our members with the financial tools they need to achieve their goals. As a not-for-profit financial institution, we return our profits back to our members in the form of better rates and lower fees. Our goal is to help you make the most of your money, and we strive to do this through a variety of products and services.

Our Services:

Checking and savings accounts

Loan options, including personal, auto, and home loans

Credit cards with competitive rates

Online and mobile banking

Investment services

And more!

Why Choose ACCU:

Local decision making

Personalized service

Competitive rates

A commitment to our community

At Access Community Credit Union, we are more than just a financial institution. We are a part of the Amarillo community and we take pride in supporting and giving back to our neighbors.

Visit us today and discover why Access Community Credit Union is the right choice for you and your financial future.

OUR STORY

In 1953, Southwestern Public Service CO (SPS) employees came together to establish Public Service Employees Credit Union. This not-for-profit cooperative would serve employees and their families growing financial needs under the mission of “people helping people.”

As the company continued to grow, so did the credit union and in 1999 Public Service Employees Credit Union was renamed and rebranded as Access Credit Union and membership was opened to select employer groups.

In July of 2003 Access was granted a community charter to allow anyone who lives, works, worships or attends school in Potter or Randall counties eligibility for membership.

The credit union operates 4 branch locations in Amarillo: 6401 S. Bell, 201 Tascosa Road, 2531 Paramount Blvd, and the Mortgage Center, 6020 I-40 West.

The credit union today looks vastly different from the one in 1953. In building on the mission of “people helping people,” the board and senior team began in the early 2000’s to refocus toward the future. “Helping You Build Financial Security” was defined as the credit union’s purpose statement under the foundational core values of “relationships, integrity and service.” Since that time the credit union has doubled in asset size, with growth sustained by making member focused decisions, and introducing member focused products and services. For Access, member focused means one thing, always providing “trusted advice” regardless of the issue or situation. We believe this helps more families in our community and those families will tell other families and friends.

What makes us different than a bank?

Bank profits generally benefit a group of shareholders who own stock in the bank. Credit union profits are returned by lower loan rates, and fees as well as higher dividend rates on deposits to all credit union members. Another major difference is that credit unions are governed by volunteer board of directors elected by the membership. At Access and at most credit unions these board members are not compensated monetarily. Simply put, credit unions offer many similar services of banks (loans, checking accounts, online banking, apps, etc) but serve a different purpose: to provide a better deal to the members.

We offer you the tools to take control of your website's content. Ensure your placement in Google's ranking and increase your leads and conversions by keeping your content up to date and relevant with runCMS.

runCMS does not rely on third party plugins that are prone to breakage. Instead, it is actively developed, hosted, and supported by the friendly and experienced staff at Run Business Solutions. That means that you don't need to worry about dealing with hard-to-reach, unreliable web hosting companies.

runCMS is powerful and easy to use. We would love to show you how it works.

Powerful Tools

RunIT CMS gives users powerful and easy to use tools to make managing website content easy. These tools are managed independently and the pages update automatically. This reduces (if not eliminates) the need to use third-party tools to accomplish goals. However, RunIT CMS allows for complete integration with custom CSS and JavaScript.

Galleries

A Gallery is a collection of images. RunIT CMS gives users the ability to create multiple Galleries. Users can upload and re-size image and add them to a Gallery. Images can be re-ordered, deactivated and given a hyperlink. ALT tags are fully accessible.

Galleries can be added to pages as thumbnails, slideshows, or thumbnail slideshows. The slideshow is powered by the Nivo Slider by Dev7studios.

Libraries

A Library is a collection of Resources. A Resource is a file with a Title and Description. A Library could be seen as a collection of files made available on a website with a title and description. Library Resources can have an expiration date added which will cause them to no longer appear on the website when the expiration date passes.

Libraries can be added to pages as simple lists of Titles that are download links or as tables with the Title, Description, File Name, and a Download button. Library downloads are tracked and are reported in the Analytics Dashboard.

Blogs

Blogs are a great way for users to publish fresh content to the world. RunIT CMS includes a Blog tool with Categories. Blog Posts can have a cover photo, can be deactivated, and are edited with the Custom Content Editor. Blog Posts have an optional expiration date.

All non-expired, active Blog Posts are added to the site's automatically generated sitemap.xml file and the site's RSS feed. Blog Posts can integrate with Calendar events, allowing users to create a blog post and a Calendar Event at the same time.

Calendars

No full-featured CMS is complete without a calendar. The RunIT CMS Calendar tool allows users to create multiple calendars, each having a name and a custom color.

Events can easily be added to a Calendar. Events have a Title, Description, Start Date/Time, End Date/Time, option for All Day Event, Reminder Date/Time, and RSVP Required. The Calendar displays on the page as either a calendar or a list of events, each being hyperlinks that open details about the event. If RSVP Required is selected, the event details will allow users to RSVP.

RunIT CMS Custom Content Editors are present throughout the system. They are WYSIWYG (What You See Is What You Get) editors that allow for content to be added and formatted in a Microsoft Word like manner. Our editor is one of the best on the market.

RunIT CMS Custom Content Editor Toolbox

The Custom Content Editors include a wide array of features for formatting text, pasting from Word, and pasting as HTML. Users can apply a CSS class from the site.css file to images and text. There is a full multi-level undo/redo mechanism with action trails like Microsoft Word. The editor includes a spell checker, find and replace tool, and a table builder. The editor also includes a powerful hyperlink manager, image manager, and document manager. The image manager allows users to edit images.

The RunIT CMS Custom Content Editor produces clean, semantic HTML markup that users can view or edit with the click of a button. This allows for advanced users to embed videos, add custom scripts or styles, and generally take total control of how the HTML is going to look.

Content Blocks

There is no reason to repeat the same action (such as copying and pasting) to update multiple pages. No one enjoys manually updating each page of a website in order to update a hyperlink or an image.

It is our goal to eliminate duplicate work when it comes to editing web content. That's what Content Blocks are all about. A content block is a piece of formatted content that can be added to pages and updated in one place. Content Blocks are edited with the Custom Content Editors, giving users complete control over the formatting (and advanced users control over the actual HTML). An example of a use case for a Content Block is a navigation sub-menu that exists in a subset of pages. Another example is a YouTube video that needs to be displayed on many pages and is subject to change.

Site Layout

Users have complete control over the way their websites look. Everything contained in the tag is editable using a Custom Content Editor. The system includes several macros for the purpose of adding the site navigation and page content in any place desired. There are also macros to get the site root, the current date/time, and to add CMS tools to the layout.know your purpose.

We take the time to understand who you are as an organization to determine how we can best serve you. Our goal is that the products and services we offer, allow you to thrive in that purpose.

empower your people.

In order for your organization to reach it’s maximum operational potential, you need the right tools. Technology is always changing, and we stay ahead of the curve to empower your people with best products and support to reach your objectives safely and efficiently.

run your business

By implementing best practices and our extensive specialized knowledge, we free you up to focus on what you do best. We eliminate costly, unnecessary distractions and downtime, giving you the predictability and confidence you need to run your business.